Are you struggling to make ends meet on a low income? It can be tough to manage your finances when money is tight. Still, there are strategies you can use to improve your financial situation. This article will explore tips and tricks for smart financial management on a tight budget.

Smart Financial Management on a Tight Budget: Strategies for Low-Income Earners

by Austin

The first step to better financial management is understanding where your money is going. Here are some ways to assess your current financial situation:

- Create a budget: Create a budget and track your expenses and income. This will help you identify areas where you can cut costs, such as reducing your cable bill or eating out less often. Consider using free or low-cost tools like spreadsheets or budgeting apps to make this process easier.

- Track your spending: Keep track of your spending for a month or two to get a clear picture of where your money is going. This can help you identify areas where you might overspend and find opportunities to cut costs.

#2 Maximizing Your Income and Benefits

It may be worth exploring additional income streams if you need help to make ends meet. Here are some ways to maximize your income and benefits:

- Freelance or take on a side hustle: Consider freelancing or taking on a side hustle to earn extra cash. For example, you could offer your services as a writer, graphic designer, or social media manager.

- Look for government and community resources: Many government and community resources are available to low-income earners, such as food assistance or job training programs. Research these options and take advantage of any benefits you're eligible for.

- Negotiate for better wages or benefits: Consider negotiating for better wages or benefits if employed. This could include asking for a raise, requesting more flexible hours, or negotiating for better health insurance.

#3 Minimizing Your Debt and Credit Usage

High-interest debt can quickly eat away at your income, so it's important to minimize your debt and credit usage as much as possible. Here are some ways to minimize your debt and credit usage:

- Pay off high-interest debt: Start by paying off any high-interest credit cards or loans you have. This will help you save on interest charges and free up more income for other expenses.

- Avoid new debt: Be cautious about new debt, especially if you struggle to meet ends. Instead, focus on paying off any existing debt you have.

- Consider alternative credit options: Consider alternatives to traditional credit, such as secured credit cards or credit unions. These options may offer lower interest rates and more flexible repayment terms.

Get ready to brew up something great - apply for barista job vacancies now.

#4 Making Smart Choices with Your Money

When money is tight, it's important to prioritize your needs versus wants. Here are some ways to make smart choices with your money:

- Cut back on non-essential expenses: Consider cutting back on non-essential expenses, such as eating out, buying new clothes, or going to the movies. Instead, focus on the essentials, such as housing, food, and transportation.

- Shop smart: When grocery shopping, try to buy in bulk or choose generic brands to save money. Consider meal planning to minimize food waste and save money on groceries.

- Choose cost-effective housing and transportation options: Consider cost-effective housing and transportation options, such as public transit, carpooling, or living with roommates.

#5 Planning for Your Future Financial Success

Finally, it's important to plan for your future financial success. Here are some ways to plan for your future financial success:

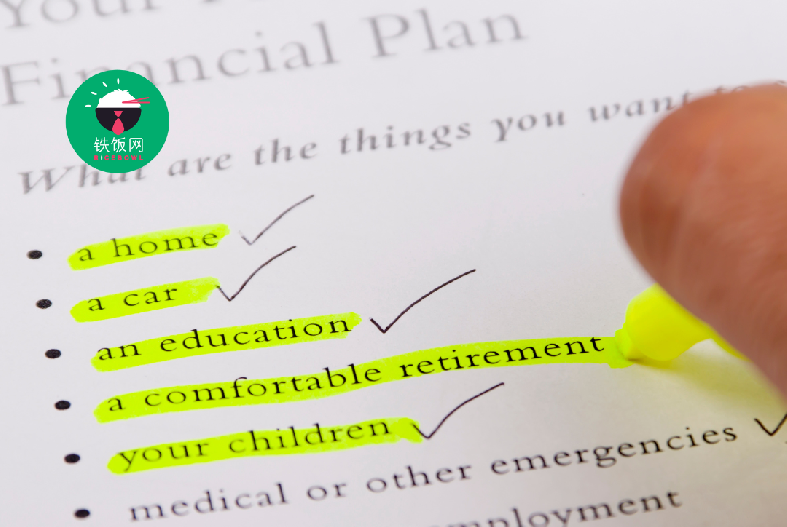

- Determine your financial goals: Identify your short-term, mid-, and long-term financial goals. This will help you prioritize your spending and make informed decisions about allocating your resources.

- Save for emergencies: Unexpected expenses can derail your financial plans. Set aside some money each month for emergencies to prepare for the unexpected.

- Invest for long-term growth: Consider investing your money in stocks, bonds, or mutual funds to build long-term wealth. Consult a financial advisor to determine the best investment options for your goals and risk tolerance.

- Protect your assets: Ensure adequate insurance coverage for your home, car, and other valuable assets. This will protect you financially in case of unexpected accidents or damage.

- Retirement plan: Start saving for retirement as early as possible, even if it's just a tiny amount each month. Consider contributing to a 401(k) or IRA and consult a financial advisor to determine the best retirement savings strategy for your goals.

- Update your plan regularly: Your financial situation will change over time, so reviewing and updating it regularly is important to ensure you're on track to meet your goals. Adjust as needed to align your plan with your changing needs and circumstances.

Question: How can I save money on groceries if I have dietary restrictions or preferences?

Answer: If you have specific dietary restrictions or preferences, it may be harder to save money on groceries. Consider looking for sales or coupons for the foods you can eat, and try to meal plan to minimize waste.

Question: How can I establish a credit history if this is the first time I've had a credit card or loan?

Answer: Building a credit history can be challenging without prior credit accounts. Consider applying for a secured credit card or credit-builder loan, and make sure to make all payments on time.

Question: What should I do if I can't afford my monthly bills?

Answer: If you can't afford your monthly bills, consider contacting creditors or service providers to negotiate a payment plan or extension. You can also look for government assistance programs or charitable organizations that can help.

Question: What if I have medical debt on a limited income?

Answer: Medical debt can be overwhelming on a limited income. Consider negotiating a payment plan with your medical provider or contacting a debt relief organization for assistance.

Question: How can I save money on housing costs if I live in a high-cost area?

Answer: Living in a high-cost area can make saving money on housing costs difficult. Consider alternative housing options, such as renting a room or sharing an apartment, and prioritize finding a place that fits your budget.

Question: How can I avoid high-interest loans if I need to borrow money?

Answer: High-interest loans can trap you in a cycle of debt. Consider looking for alternative borrowing options, such as community organizations or credit unions, and read the fine print on any loan agreement.

Question: What if I need a better credit score and can't qualify for loans or credit cards?

Answer: Having a poor credit score can limit your borrowing options. Consider working with a credit counsellor or financial advisor to create a plan to improve your credit score. Look for alternative borrowing options that don't require a credit check.

Question: How can I save money on transportation costs if I don't have access to public transit?

Answer: Living in a rural area or small town can make saving money on transportation costs difficult. Consider carpooling with neighbours or coworkers, or look into buying a fuel-efficient vehicle to save on gas.

Question: How can I save for retirement on a limited income?

Answer: Saving for retirement can be challenging on a limited income. Consider contributing to a workplace retirement account, such as a 401(k), or opening an individual retirement account (IRA) and contributing what you can each month.