The average life expectancy of Malaysians is 75 years old. The current legal retirement age is around 60 years old. Is it really enough if you only rely on the EPF?

How Much Do You Need To Comfortably Retire In Malaysia?

by David Blog

We need at least 15 years of unpaid, zero-income pensions.

Do you have enough money to cover your retirement?

How much money has to be saved, so that we don’t have to worry about money when we are old?

According to the calculation of the EPF, the basic cost of retirement is RM 950 per month.

Assuming you retire at the age of 60, your monthly expenses are as follows:

Basic expenses (clothing, food and accommodation): RM 950 / month

1 year is equal to RM 11,400

You need RM 228,000 in 20 years!

And this is just the basic cost! It only includes food, clothing, accommodation, and not including your medical card, travel, etc.!

I haven't counted the inflation rate in Malaysia and the debt of buying a house to buy a car which will be extra expenses.

Not to mention that your life may be over 75 years old!

RM 228 K is only the most conservative estimate. Furthermore, two-thirds of the members of the EPF are not even RM50,000 when they retire!

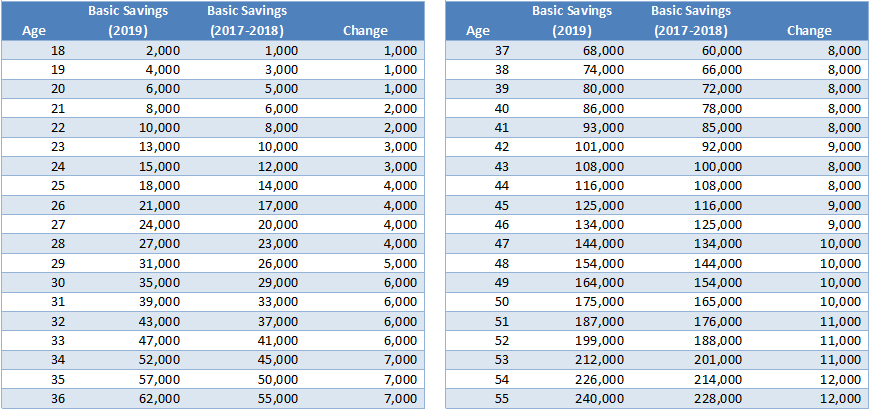

In fact, according to this list of pension savings recommendations, our EPF should have more than RM 30k savings before the age of 30!

Suppose that the monthly living expenses of average 60 years olds in Malaysia after retirement are conservatively estimated at RM 1000. At the annual inflation rate of 2%, if they live to 75 years old, the number blows up to RM 458,400 before the age of 60!

It takes a lot of money to retire! This is why many financial experts recommend that the sooner you start saving, the better. Moreover, in addition to your EPF, you can also refer to other reliable ways to increase income, such as: trust funds, savings insurance, and so on.